Starting a business in Nigeria is an exciting venture, but you need legal registration to ensure legitimacy, access loans, and qualify for government incentives. Thanks to the Corporate Affairs Commission (CAC)’s fully online portal, you can now register faster and more efficiently than ever.

I’m going to give you a step-by-step breakdown of how to register your business online in Nigeria in 2025, including:

- Latest CAC portal updates

- Cost breakdown for different business types

- How to avoid registration delays

- Post-registration compliance

1. Why Register Your Business in Nigeria?

Legal Benefits

• Business Legitimacy – Required for opening a corporate bank account

• Access to Loans & Grants – Many government programs require CAC registration

• Legal Protection – Separates personal assets from business liabilities

See How to Get a Scholarship Abroad (For Nigerians)

Financial Benefits

• Tax Advantages – Registered businesses qualify for tax incentives

• Investor Confidence – Attracts partnerships and funding

Operational Benefits

• Brand Protection – Secures your business name nationwide

• Government Contracts – Eligibility for tenders and grants

2. Types of Business Structures in Nigeria

| Business Type | Best For | Registration Cost (2024) |

|---|---|---|

| Sole Proprietorship | Individual owners (small businesses) | ₦10,000 – ₦15,000 |

| Limited Liability Company (LTD) | Startups & SMEs | ₦20,000 – ₦50,000 |

| Public Limited Company (PLC) | Large corporations | ₦100,000+ |

| Business Name (BN) | Informal traders & freelancers | ₦10,000 – ₦15,000 |

3. Pre-Registration Checklist

Before registering, ensure you have:

✅ Business Name (Check availability on CAC portal)

✅ Registered Office Address (Required for CAC filing)

✅ Valid ID (National ID, Passport, or Driver’s License)

✅ Email & Phone Number (For verification)

✅ Memorandum & Articles of Association (For LTD/PLC)

4. Step-by-Step Online Business Registration (2024)

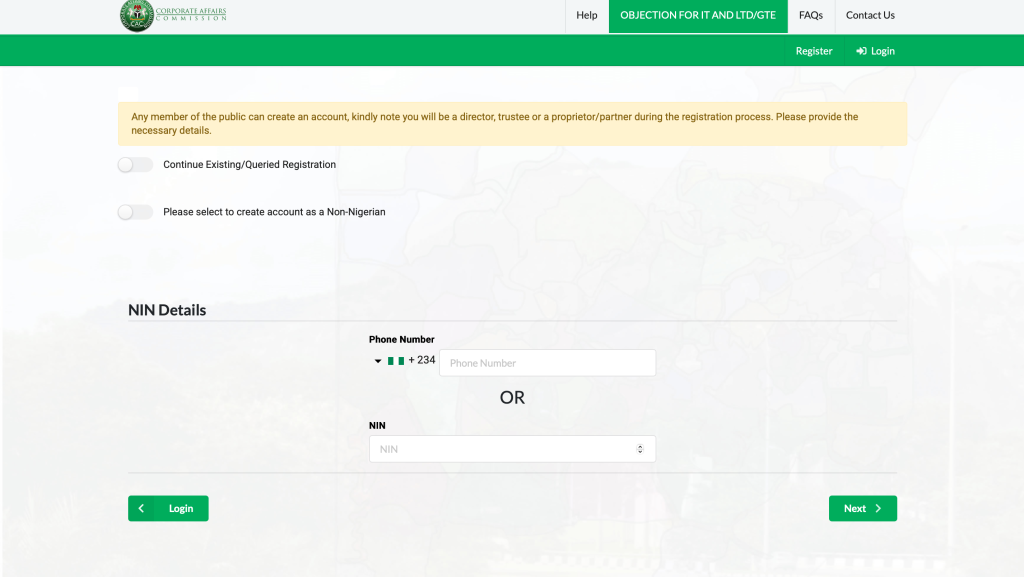

Step 1: Visit the CAC Portal

• Go to https://pre.cac.gov.ng

• Click “Register a Business”

Step 2: Reserve Your Business Name

• Search for name availability (e.g., “XYZ Enterprises”)

• Pay ₦500 for name reservation

Step 3: Complete Registration Form

Fill in:

- Business type (LTD, BN, etc.)

- Owner(s) details

- Company address

Step 4: Upload Required Documents

For Sole Proprietorship/BN:

- ID Card (Passport, Driver’s License)

- Passport photo

For LTD/PLC:

- Memorandum & Articles of Association

- Board Resolution

Step 5: Pay Registration Fees

Payment Methods:

- Remita (Bank transfer, card, USSD)

- Cost ranges from ₦10,000 (BN) to ₦50,000 (LTD)

Step 6: Receive Your Certificate

Processing Time: 1-3 working days

Download e-certificate from CAC portal

5. Post-Registration Requirements

A. Tax Registration (FIRS & State IRS)

- Register for Tax Identification Number (TIN) via FIRS Portal

- VAT Registration (If applicable)

B. Business Bank Account

- Required Documents: CAC certificate, ID, utility bill

- Top Banks: Zenith, GTBank, Access

C. Necessary Licenses (Industry-Specific)

- NAFDAC (For food/drug businesses)

- SONCAP (For importers)

6. Common Mistakes to Avoid

❌ Choosing a name already taken (Check CAC portal first, very important to avoid a waste of your time)

❌ Incorrect business classification (LTD vs. BN)

❌ Skipping tax registration (Leads to penalties)

7. FAQs on Business Registration in Nigeria

Q1: How long does registration take?

✅ 1-3 days (Online) | 1-2 weeks (Manual)

Q2: Can a foreigner register a business in Nigeria?

✅ Yes, but requires a Nigerian director.

Q3: Do I need a lawyer to register?

✅ No, but consultants can speed up the process.

8. Conclusion

Registering your business online in Nigeria is now easier than ever with the CAC’s digital portal. Follow this guide to avoid delays, stay compliant, and launch your business successfully in 2025.